Description

Steady equity growth with low turnover!

Sapphire is a rotational long-only trend-following model portfolio which tracks stocks in the Australian ASX All Ordinaries Index. It ranks and rotates stocks weekly on each weekend and enters and exits the following Monday. It has filters for market regime, liquidity and volatility. It features smooth steady returns and capital protection during extreme market volatility. Subscribe to the Sapphire model portfolio and gain access to weekly rotations and trades published each weekend. Access the model information via the website, or have it sent direct to your email inbox. Model portfolio updates are provided for educational and informational use only. Please make note of the disclaimer displayed at the foot of this page.

Strategy signals can be used directly with The Smart Stock Trade Automation Engine

Features

- Trend following rotational approach

- Trades ASX All Ordinaries stocks

- Trades weekly

- High expectancy per trade

- Long holding period

- Low turnover

- Smooth consistent returns

- Inbuilt protection from volatile market conditions

- Position Size of 5% of equity per position (70% fully invested with 30% cash buffer)

Sapphire Key Metrics

- Compound Annual Return: 20%

- Max Historical Drawdown: 26%

- Average Holding Period: 15 Weeks

- Average Trades Per Year: 46

- Expectancy Per Trade: 9.1%

- Win Rate: 51%

Performance Charts

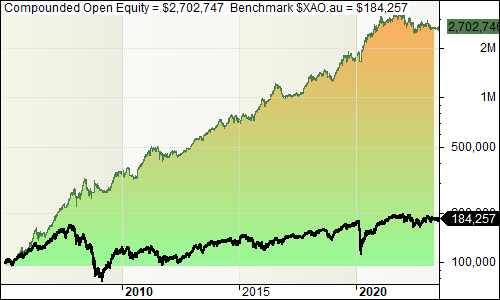

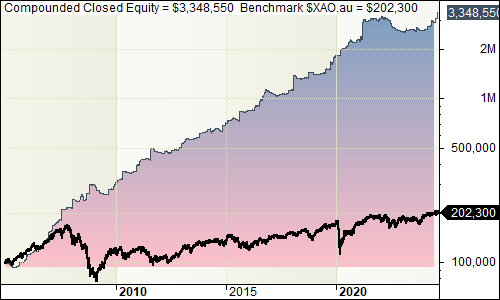

Portfolio Equity

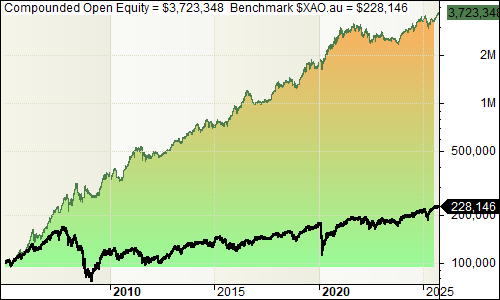

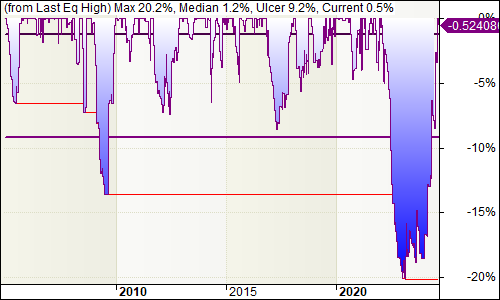

Open Equity Drawdown

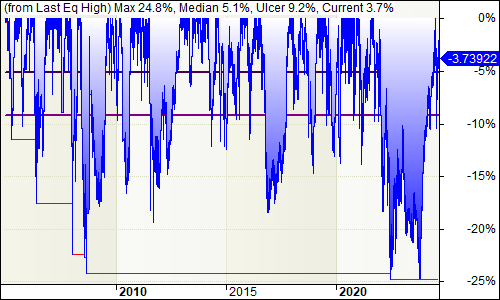

Annual Returns

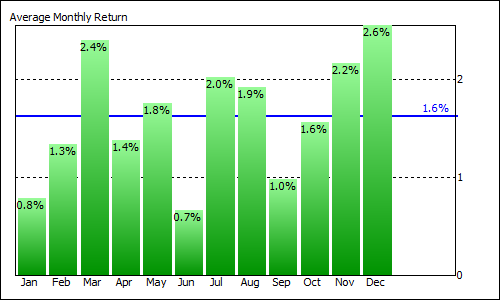

Average Monthly Returns

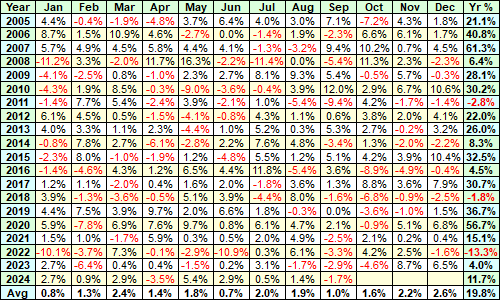

Profit Table

Portfolio Closed Equity

Closed Equity Drawdown

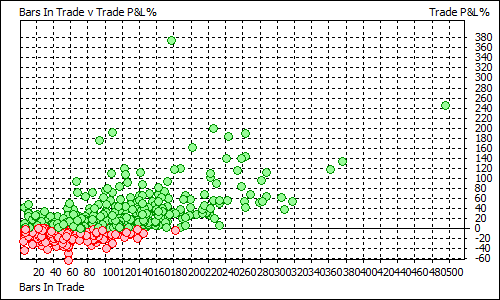

Trade Duration v P&L

Sapphire Key Features

Sapphire aims to produce smooth consistent gains profiting from market momentum, with a medium term holding period, low turnover and aggressive risk management.

| Approach | Rotational Trend Following |

| Direction | Long only |

| Stock Universe | Constituents of the ASX All Ordinaries Index |

| Liquidity Filter | System has minimum price and turnover liquidity filters built in to avoid trading illiquid issues |

| Volatility Filter | A volatility filter eliminates stocks with very low volatility such as takeover stocks and those with few trades. |

| Ranking Score | A momentum based ranking methodology is used to determine the strongest stocks in the index. This measures the strength of all stocks on a scale of 0 to 100 – higher is stronger. Any stocks failing to pass the other system filters are scored at zero. |

| Market Regime Filter | A market based regime filter ensures that during very adverse market conditions, only the strongest stocks with a very high ranking score continue to be held. |

| Max Positions | The system aims to hold up to 14 of the strongest stocks in the index, subject to the above filters |

| Rotation | Stocks are re-ranked weekly on a Friday. Any holdings falling out of the top 21 or otherwise eliminated by the filters are sold and the remainder are held. Any new entrants to the top 14 list are bought, subject to a free slot being available. |

| Position Size | The system is based on a fixed fractional position size of 5% of account capital per position, giving a maximum capital investment of 70% when fully committed. 30% is held as a cash reserve to act as a buffer against drawdowns. If fewer than 14 stocks are available to be held, the balance is held in cash. |

| Exit Strategy | The system has two complementary exit triggers. The primary exit is momentum based and will sell down a stock that has lost momentum relative to other holdings when it’s no longer strong enough to remain in the holdings list of ranked stocks. The momentum based exit will tend to exit in the middle of the price range during the “distribution” phase following an uptrend and will tend to avoid capitulation points, such as where price-based stops would normally be triggered. This action of selling a stock losing momentum whilst buying a stock gaining momentum also produces a smoothing effect in the results. Additionally the market regime filter will sell down holdings and reduce risk when market-wide conditions turn adverse. |

| Executions | Buy and Sell signals are available on a Saturday. Trade executions are made at the following Monday’s market open. |

Each weekend, the full list of index rankings, trade history and system results are published on the website and emailed to subscribers. A listing of the holdings along with any buys and sells are provided by email to subscribers.