Description

Performance Charts

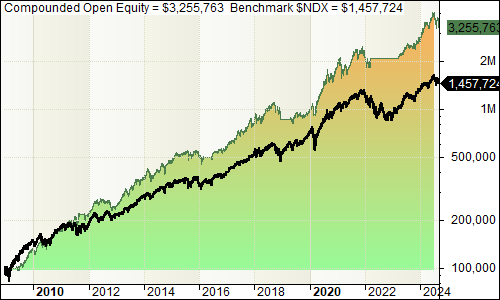

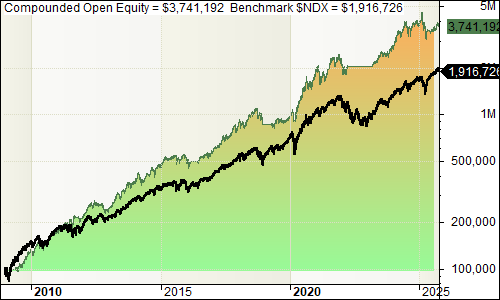

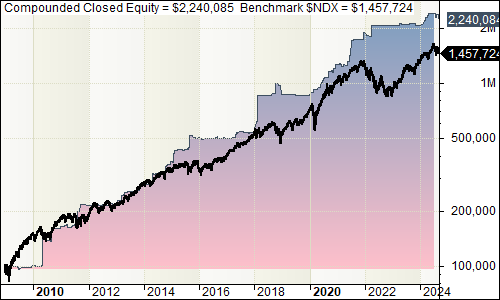

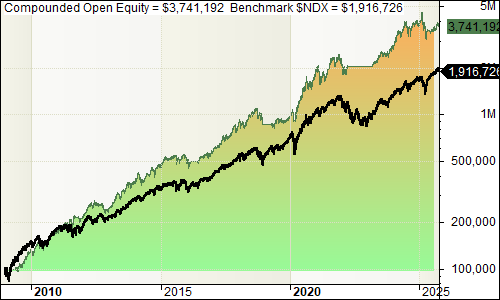

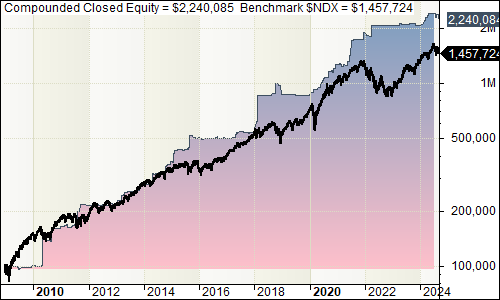

Portfolio Equity

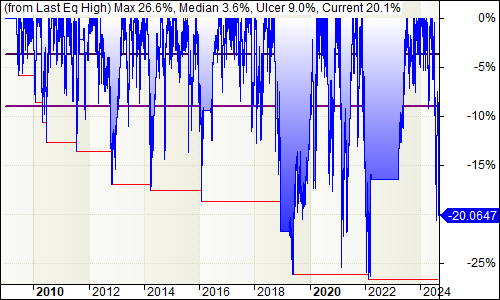

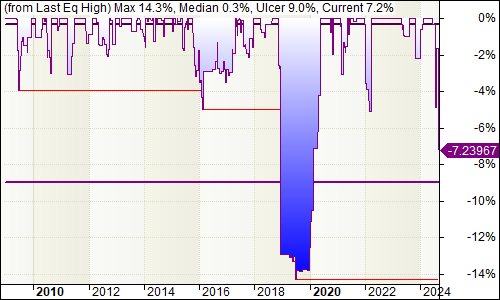

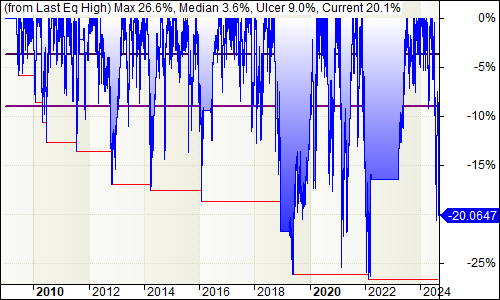

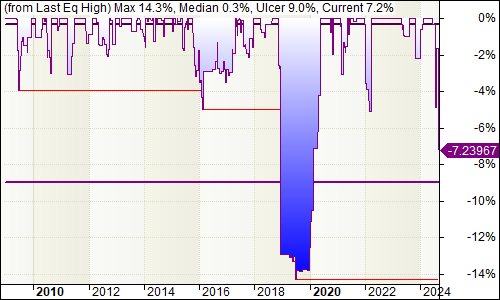

Open Equity Drawdown

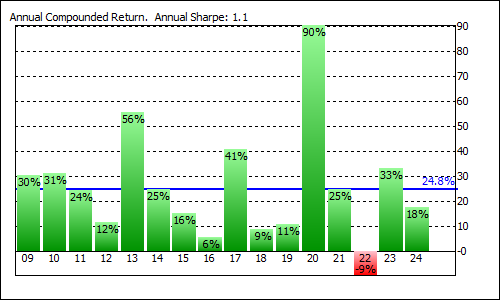

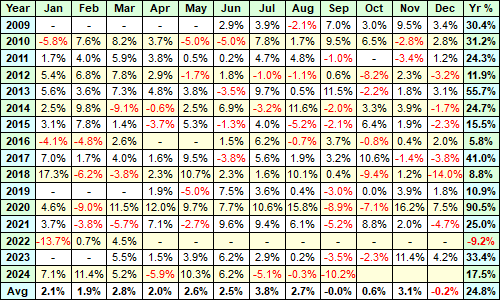

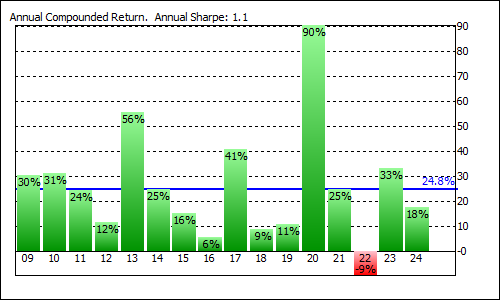

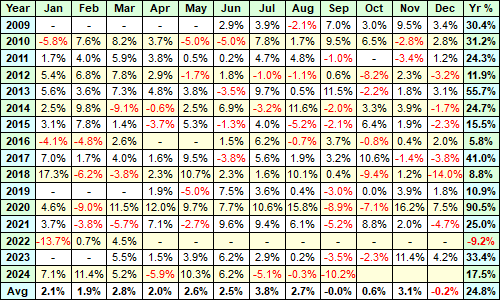

Annual Returns

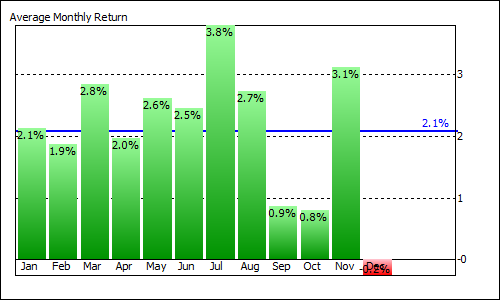

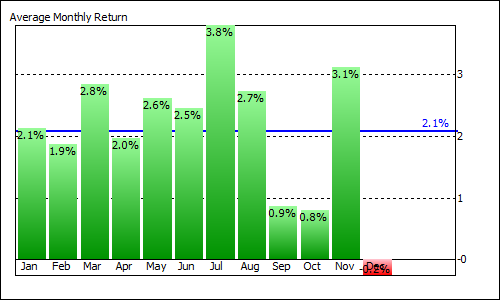

Average Monthly Returns

Profit Table

Portfolio Closed Equity

Closed Equity Drawdown

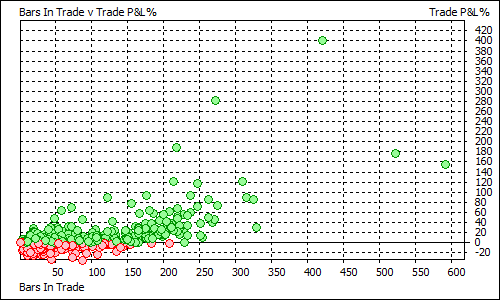

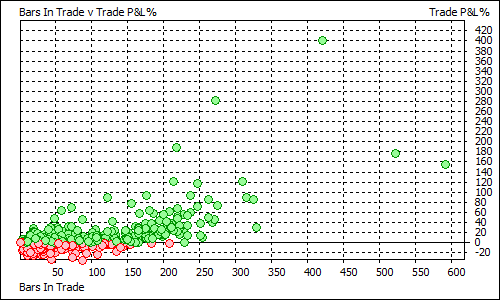

Trade Duration v P&L

Monterey Features

Monterey aims to produce smooth consistent gains profiting from market momentum, with a medium term holding period, low turnover and aggressive risk management.

| Approach | Rotational Trend Following |

| Direction | Long only |

| Stock Universe | Constituents of the Nasdaq 100 Index |

| Liquidity Filter | System has minimum price and turnover liquidity filters built in to avoid trading illiquid issues |

| Volatility Filter | A volatility filter eliminates stocks with very low volatility such as takeover stocks and those with few trades. |

| Ranking Score | A momentum based ranking methodology is used to determine the strongest stocks in the index. This measures the strength of all stocks on a scale of 0 to 100 – higher is stronger. Any stocks failing to pass the other system filters are scored at zero. |

| Market Regime Filter | A market based regime filter ensures the system only trades when market conditions are favourable and seeks to reduce risk when otherwise. |

| Max Positions | The system aims to hold up to 10 of the strongest stocks in the index, subject to the above filters |

| Rotation | Stocks are re-ranked weekly on a Friday. Any holdings falling out of the top 10 or otherwise eliminated by the filters are sold and the remainder are held. Any new entrants to the top 10 list are bought, subject to a free slot being available. |

| Position Size | The system is based on a fixed fractional position size of 10% of account capital per position. If fewer than 10 stocks are available to be held, the balance is held in cash. |

| Exit Strategy | The system has two complementary exit triggers. The primary exit is momentum based and will sell down a stock that has lost momentum relative to other holdings when it’s no longer strong enough to remain in the holdings list of ranked stocks. The momentum based exit will tend to exit in the middle of the price range during the “distribution” phase following an uptrend and will tend to avoid capitulation points, such as where price-based stops would normally be triggered. This action of selling a stock losing momentum whilst buying a stock gaining momentum also produces a smoothing effect in the results. Additionally the market regime filter will sell down holdings and reduce risk when market-wide conditions turn adverse. |

| Executions | Buy and Sell signals are available on a Friday evening (USA Eastern Time) after the market is closed and once the data is available for processing. Trade executions are to be made at the following Week’s market open. |

Each weekend, the full list of index rankings, trade history and system results are published on the Helix Trader website and are available to be viewed by subscribers. A listing of the holdings along with any buys and sells are provided by email to subscribers.

Steady equity growth with low turnover!

Monterey is a rotational long-only trend-following model portfolio which trades stocks in the Nasdaq 100 Index. It ranks and rotates stocks weekly on a Friday and includes risk management filters for market regime, liquidity and volatility. It features smooth steady returns and capital protection during adverse market conditions. Subscribe to the Monterey model portfolio and gain access to weekly rotations and trades published each Friday evening (US Eastern Time). Access the model information via the website and have the signals sent direct to your email inbox.

Strategy signals can be used directly with The Smart Stock Trade Automation Engine.

Key Features

- Trend following rotational approach

- Trades Nasdaq 100 stocks

- Trades weekly

- High expectancy

- Long holding period

- Low turnover

- Smooth consistent returns

- Inbuilt protection from adverse market conditions

Monterey Key Metrics

- Compound Annual Return: 24%

- Max Historical Drawdown: 34%

- Average Holding Period: 16 Weeks

- Average Trades Per Year: 26

- Expectancy Per Trade: 10.6%

- Win Rate: 59%

Performance Charts

Portfolio Equity

Open Equity Drawdown

Annual Returns

Average Monthly Returns

Profit Table

Portfolio Closed Equity

Closed Equity Drawdown

Trade Duration v P&L

Monterey Features

Monterey aims to produce smooth consistent gains profiting from market momentum, with a medium term holding period, low turnover and aggressive risk management.

| Approach | Rotational Trend Following |

| Direction | Long only |

| Stock Universe | Constituents of the Nasdaq 100 Index |

| Liquidity Filter | System has minimum price and turnover liquidity filters built in to avoid trading illiquid issues |

| Volatility Filter | A volatility filter eliminates stocks with very low volatility such as takeover stocks and those with few trades. |

| Ranking Score | A momentum based ranking methodology is used to determine the strongest stocks in the index. This measures the strength of all stocks on a scale of 0 to 100 – higher is stronger. Any stocks failing to pass the other system filters are scored at zero. |

| Market Regime Filter | A market based regime filter ensures the system only trades when market conditions are favourable and seeks to reduce risk when otherwise. |

| Max Positions | The system aims to hold up to 10 of the strongest stocks in the index, subject to the above filters |

| Rotation | Stocks are re-ranked weekly on a Friday. Any holdings falling out of the top 10 or otherwise eliminated by the filters are sold and the remainder are held. Any new entrants to the top 10 list are bought, subject to a free slot being available. |

| Position Size | The system is based on a fixed fractional position size of 10% of account capital per position. If fewer than 10 stocks are available to be held, the balance is held in cash. |

| Exit Strategy | The system has two complementary exit triggers. The primary exit is momentum based and will sell down a stock that has lost momentum relative to other holdings when it’s no longer strong enough to remain in the holdings list of ranked stocks. The momentum based exit will tend to exit in the middle of the price range during the “distribution” phase following an uptrend and will tend to avoid capitulation points, such as where price-based stops would normally be triggered. This action of selling a stock losing momentum whilst buying a stock gaining momentum also produces a smoothing effect in the results. Additionally the market regime filter will sell down holdings and reduce risk when market-wide conditions turn adverse. |

| Executions | Buy and Sell signals are available on a Friday evening (USA Eastern Time) after the market is closed and once the data is available for processing. Trade executions are to be made at the following Week’s market open. |

Each weekend, the full list of index rankings, trade history and system results are published on the Helix Trader website and are available to be viewed by subscribers. A listing of the holdings along with any buys and sells are provided by email to subscribers.