Description

Short holding period with a very high win rate!

Dolphin is a short term mean reversion model portfolio which trades the US ETF QLD, which represents a 2X movements in the Nasdaq 100 index. It generates buy and sell signals after US trading hours have completed, and publishes them for execution the following trading day. All orders can be placed out of market hours. It features a high win rate, a short holding period and lower market risk than trend following approaches. Subscribe to the Dolphin model portfolio and gain access to daily signals published each weekday. Access the model information via the website and have the signals sent direct to your email inbox. Model portfolio updates are provided for educational and informational use only. Please make note of the disclaimer displayed at the foot of this page.

Strategy signals can be used directly with The Smart Stock Trade Automation Engine

Key Features

- Short term mean reversion approach

- Trades QLD

- Trades daily

- High win rate

- Short holding period

- Smooth consistent returns

Dolphin Key Metrics

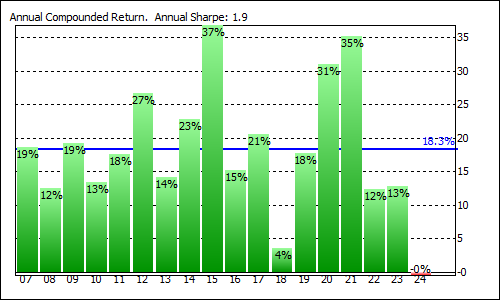

- Compound Annual Return: 18%

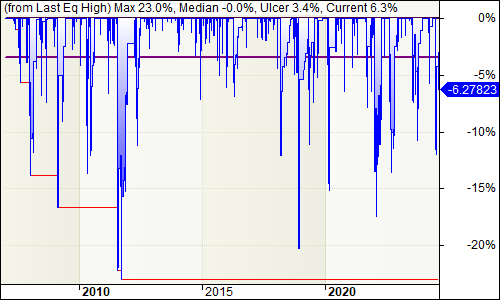

- Max Historical Drawdown: 23%

- Average Holding Period: 1 Weeks

- Average Trades Per Year: 15

- Expectancy Per Trade: 2.3%

- Win Rate: 89%

Performance Charts

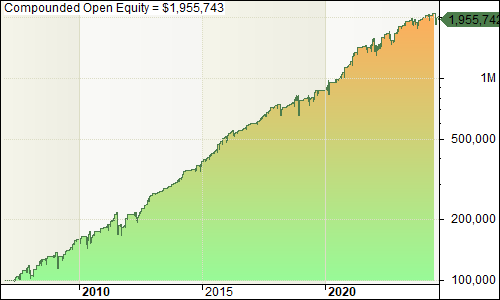

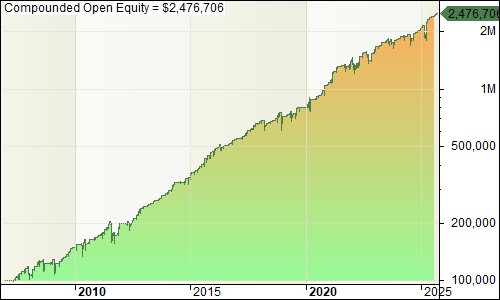

Portfolio Equity

Open Equity Drawdown

Annual Returns

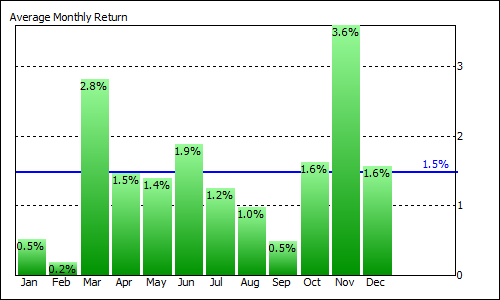

Average Monthly Returns

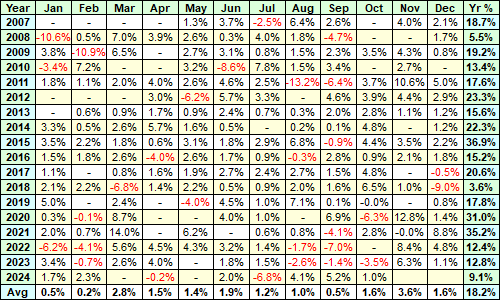

Profit Table

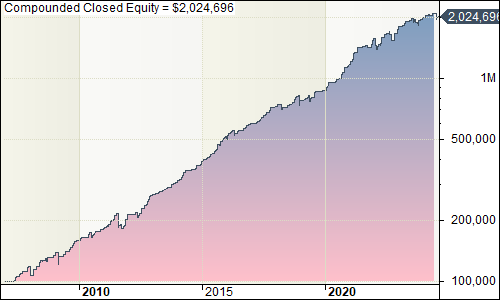

Portfolio Closed Equity

Closed Equity Drawdown

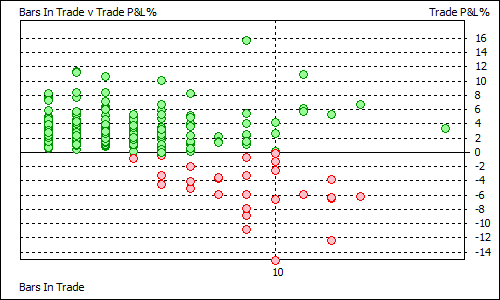

Trade Duration v P&L

Dolphin Features

Dolphin aims to produce smooth consistent gains profiting from a reversion to the mean, with a short term holding period, low turnover and a high win rate.

| Approach | Short Term Mean Reversion |

| Direction | Long only |

| Stock Universe | QLD ETF (2X Nasdaq 100 Index) |

| Liquidity Filter | Not required |

| Trend Filter | Not required |

| Volatility Filter | Seeks periods where short term volatility is high and expected to fall |

| Oversold Filter | The strategy identifies areas where the ETF has been sold off hard in the short term |

| Limit Order Entry | Entry orders are placed overnight, ahead of the next day’s action, using Limit On Close (LOC) orders. There are up to 3 scaling entries, all LOC. |

| Overbought Filter | A dynamic profit target is used as an exit signal |

| Time Stop | None |

| Max Positions | The system only holds a single ETF at any one time |

| Position Size | The 3 entries are sized at 40%, 20% and 40% of a full position size respectively. |